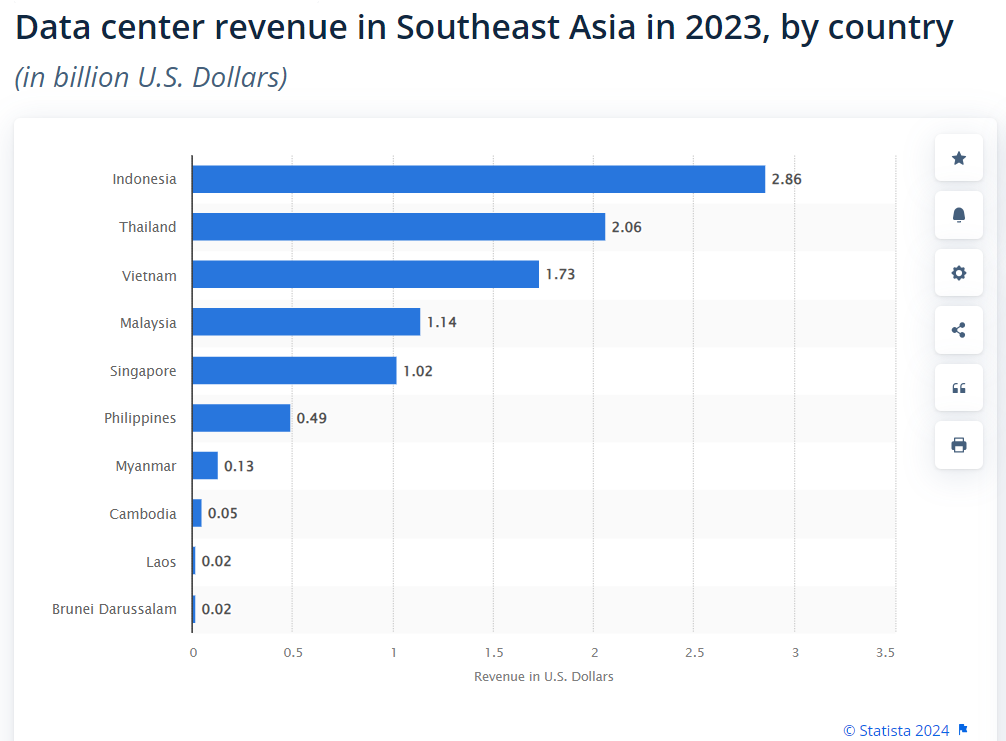

Vietnam’s data center revenue secures the third spot among Southeast Asian countries in 2023 (Statista 2024)

Vietnam’s 2023 Telecommunications Law, which took effect on July 1, 2024, marks a significant step forward in the country’s digital transformation journey. This legislation opens the door for foreign investment in the emerging cloud and data center markets.

One of the most notable amendments in the 2023 Telecommunications Law is the relaxation of foreign ownership restrictions in the telecommunications sector. Previously, foreign entities faced significant limitations, with foreign ownership in local companies capped at 49%. This amendment also aligns with the cybersecurity law which obligates foreign cloud service providers and technology firms whose core business operations require significant data processing power to park data within the country.

Previously, multinational technology firms had to form partnerships with local technology companies to establish data centers locally. However, this has been unable to keep up with the surge in demand for data processing capabilities.

Statistics from Savills show that Vietnam is home to 33 data centers, with four domestic players – VNPT, FPT Telecom, CMC Telecom, and Viettel IDC – commanding 97% of the market. According to Article 29 of the Telecommunications Law, foreign ownership is no longer limited in the data center and cloud sectors.

Under Government Decree 72/2013/ND-CP, organizations and enterprises that establish social networks in Vietnam must place their servers within the country. The new regulations on foreign investment and simpler procedures align Vietnam’s regulations with international standards, attracting foreign investors. Unlike before, foreign investors such as cloud service providers can now actively take more significant equity positions in the industry to cash in on Vietnam’s digital economy which is deemed as one of the fastest-growing markets in Southeast Asia. According to Savills, the Vietnamese data center market is projected to be valued at US$1.04 billion by 2028, presenting lucrative opportunities for investors.

Vietnam recognizes the importance of attracting large tech companies’ investments, which is why the Prime Minister is personally overseeing the National Committee on Digital Transformation to create an environment that fosters innovation. For instance, the Japanese tech giant NTT is exploring substantial investments in Vietnam’s data center market. Additionally, other cloud service providers such as Amazon Web Services and Alibaba are considering constructing data centers or establishing server zones in Vietnam. Alibaba’s project in Vietnam is estimated to cost US$1 billion.

The influx of foreign investment in the data center sector will likely lead to significant infrastructure development, including industrial zone real estate. This will involve the construction of new data centers, the expansion of existing facilities, and the deployment of cutting-edge technologies. Recently, Hyosung Corporation, the third largest South Korean investor in Vietnam after Samsung and LG, has partnered with the local company Coteccons to build a US$300-million data center in Saigon Hi-Tech Park (SHTP) in Ho Chi Minh City. Similarly, CMC Corporation, a prominent local technology company, has developed its subsidiary named CMC AI Digital Infrastructure Co., Ltd. with initial charter capital of VND300 billion (US$11.8 million) to establish a hyperscale data center in Ho Chi Minh City.

The Ministry of Information and Communications has also put forward a draft government decree guiding the implementation of the new Telecommunications Law. This draft includes more specific regulations allowing foreign companies to invest in and even fully own data centers, Over the Top (OTT), and cloud computing services. Another promising initiative of the Vietnamese Government is the proposal of a data bonded warehouse in Ba Ria-Vung Tau Province. As part of a broader economic development plan for southeastern Vietnam, this project aims to create a hub for data storage and processing that caters to both domestic and international clients.

Despite making significant strides, Vietnam faces challenges in competing with its regional counterparts, as highlighted by statistics from Statista. According to Statista, Vietnam’s data center market generated US$1.73 billion in revenue in 2023, which lagged behind Indonesia and Thailand, where the figures stood at US$2.86 billion and US$2.06 billion, respectively. These countries have more favorable legislative frameworks and a more skilled workforce, which has enabled them to attract foreign investors in high technologies years ahead of Vietnam. To address this gap, Vietnam needs comprehensive solutions to enhance the quality of its labor force, infrastructure, and industrial real estate, in addition to creating a new legislative framework that fosters a supportive investment environment. These measures can further solidify Vietnam’s potential as one of the leading data center destinations in the Asia-Pacific region.

Data centers and advanced processing technologies are pivotal to implementing Vietnam’s national digital transformation since these infrastructures serve as the backbone for storing, managing, and processing vast amounts of data. The 2023 Telecommunications Law has also introduced more favorable conditions for social network providers. By facilitating seamless communication, efficient cloud services, and secure data storage, they empower businesses, government agencies, and individuals. As Vietnam embraces e-commerce, telemedicine, smart cities, and Industry 4.0, robust data centers ensure reliable connectivity, enable innovation and support efficient operations.

(*) Hoai Anh Do is CEO, Pioneer Marketing & Public Affairs

(**) Hang Nguyen is Public Affairs Associate, Pioneer Marketing & Public Affairs

Please view the original article here: https://english.thesaigontimes.vn/new-telecommunications-law-unlocks-opportunities-for-vietnams-digital-transformation/